does binance send tax forms canada

Took about 10 minutes for the transaction to go through. Plagued by regulatory legal disputes around the globe.

Ocryptocanada How To Report Your Crypto Taxes In Canada In 2022

Once it was on there I bought ETH with it then sent that ETH to my Binance account.

. It performs over 1400000 transactions per second. No Binance doesnt provide a specific Binance tax report - but it is partnered with a variety of excellent crypto tax apps like Koinly that. If Roger is locked out of his account it will be impossible for him to gain access to his transaction history which he needs to accurately report his taxes.

Then I sent most of those coins to offline wallets leaving some on Binance to trade. Binance will be launching the Tax Reporting Tool at 2021-07-28 0400 AM UTC a new API tool to allow Binance users to easily keep track of their crypto activities in order to ensure they are fulfilling the reporting requirements laid out by their regulatory bodies. In the summer of 2018 an international coalition of tax administratorsincluding the Canada Revenue Agency CRA and the United States Internal Revenue Service IRSpromised to pool their resources and expose cryptocurrency users who dodged their tax obligations.

Binance is ranked 19 of 199 in Canada for online crypto exchanges. It is secure and 100 safe to trade there. Here is how to withdraw money from Binance to your bank account.

The ownership of any investment decisions exclusively vests with you after analyzing all possible risk factors and by exercising your own independent discretion. Full integration with popular exchanges and wallets in Canada with more jurisdictions to come. BinanceUS does NOT provide investment legal or tax advice in any manner or form.

If this fails you should reach out to a tax professional who can. Binance enables exchanging cryptos for Canadians. In order to buy and sell cryptos across the Binance network go to the Trade dropdown menu and select P2P.

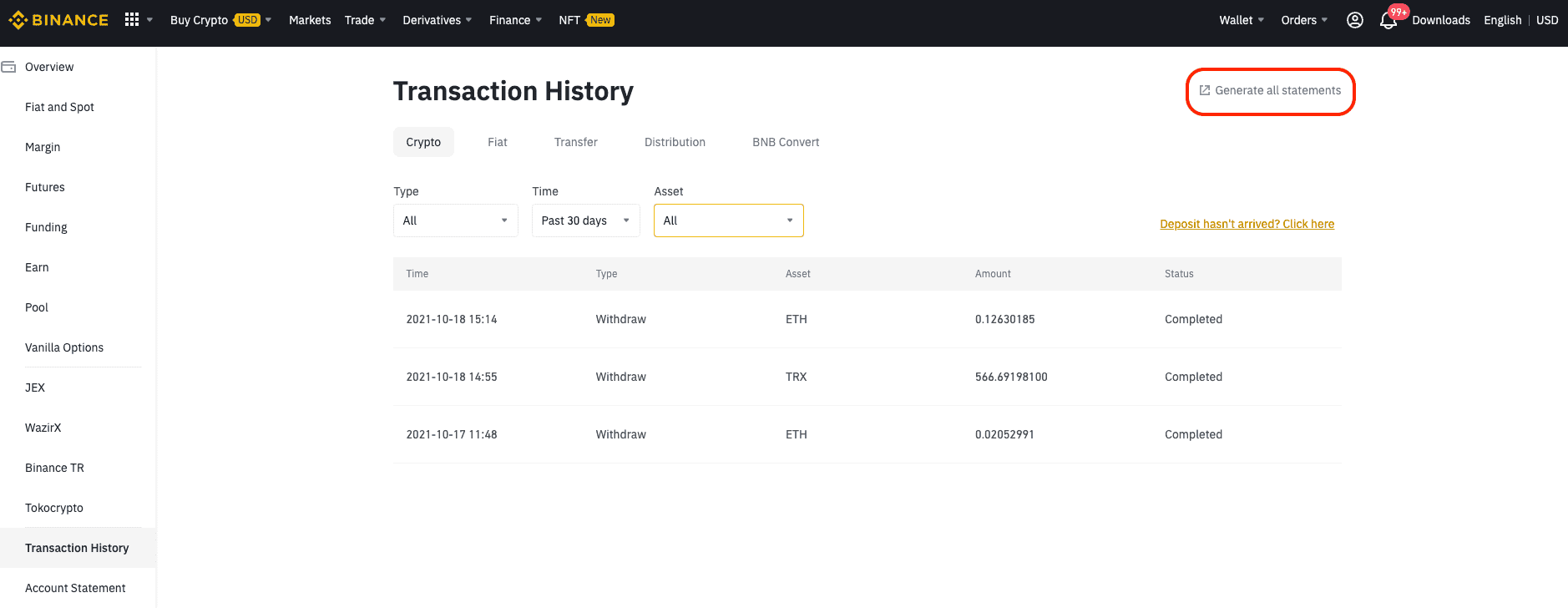

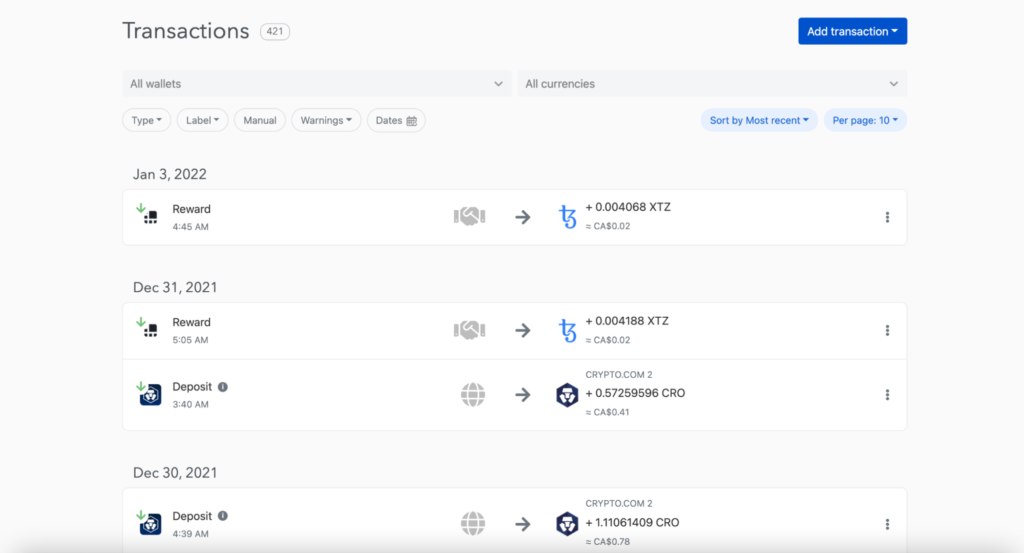

Straightforward UI which you get your crypto taxes done in seconds at no cost. Wait for the withdrawal to complete. By law the exchange needs to keep extensive records of every transaction that takes place on the platform.

The IRS states that US taxpayers are required to report gains and losses or income earned from crypto rewards based on certain thresholds on their annual tax return Form 1040. Binance is one of the largest and most comprehensive cryptocurrency exchanges in the world. Income 2021 Income 2022 15.

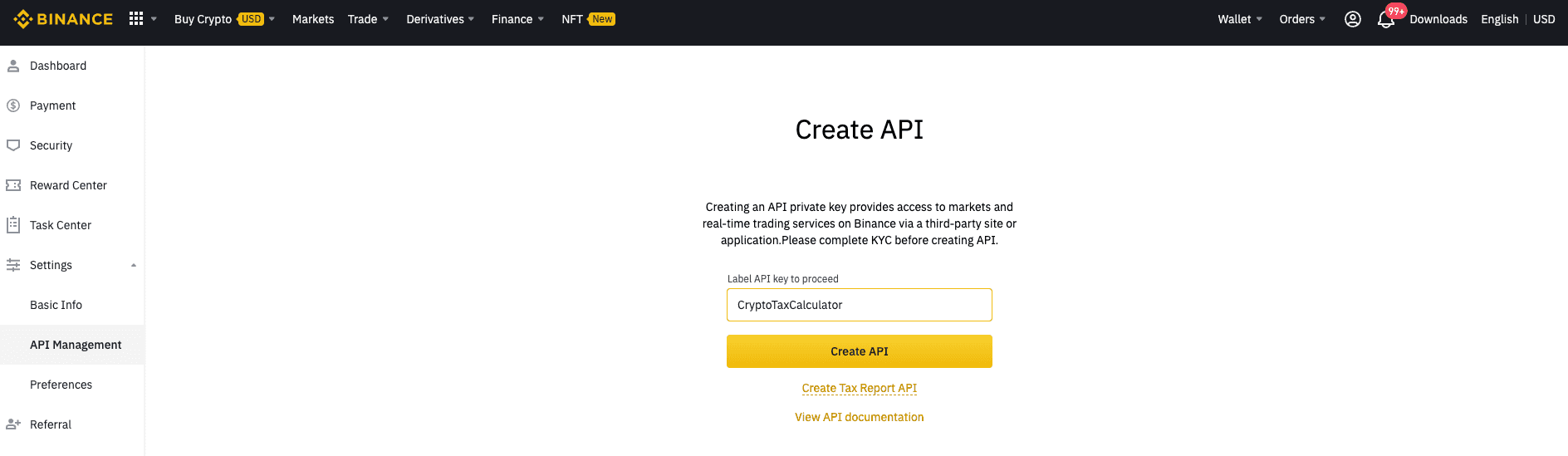

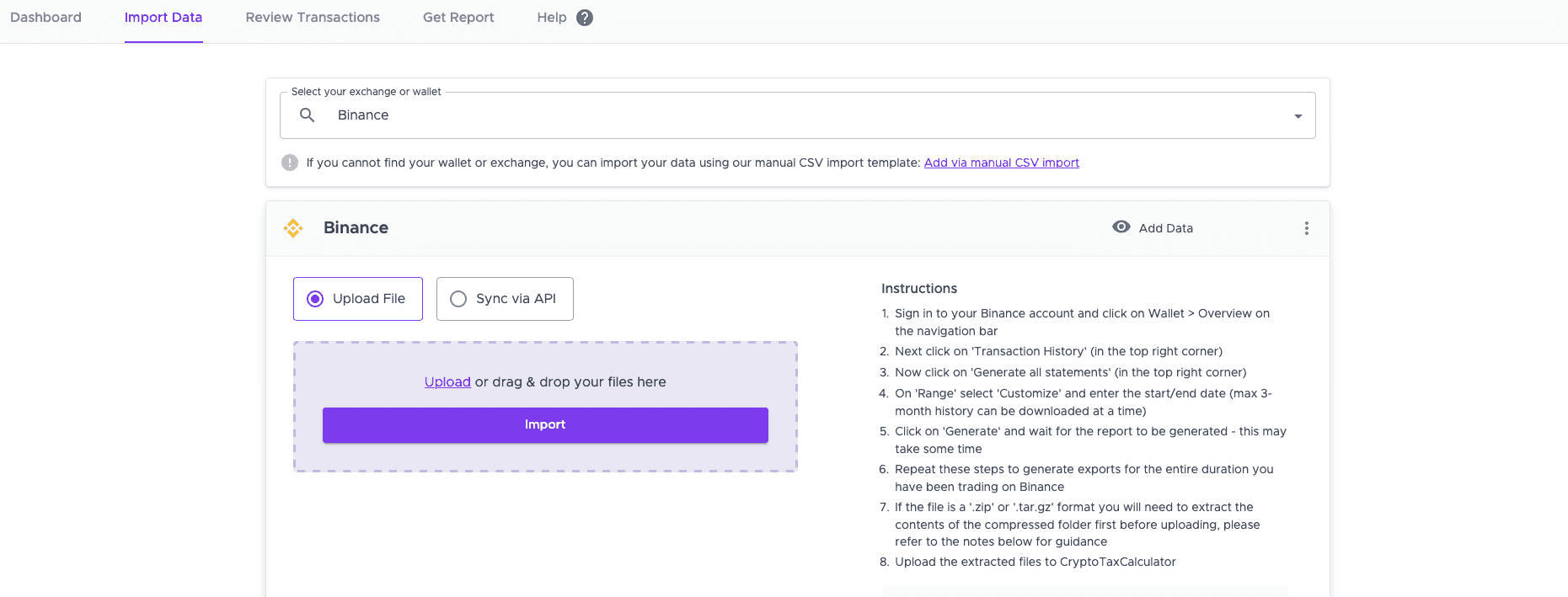

Users can access the Tax Reporting Tool via Account API Management. Three of the main jurisdictions where this happens are the United Kingdom the United States and Canada. We explore what it offers pros and cons fees and more in our review.

Fully integrated with 20 exchanges and wallets it allows users to. Go to your fiat and spot wallet. You can see the Federal Income Tax rates for the 2021 and 2022 tax years below.

But remember - youll only pay tax on half your capital gain. Report the resulting gain or loss as either business income or loss or a capital gain or loss. Since then the CRA the IRS and other tax administrators have only fine.

At any time during 2020 did you receive sell send exchange or otherwise acquire any financial interest. Were excited to share that US. Enter your card information.

Select currency payment method and withdrawal info. Does Binance provide a tax report. BinanceUS shall not be liable for any consequences thereof.

It is a one stop shop for cryptocurrency trading buying and. Complete the security verification. If you find yourself in this situation reach out to Binances support team for a copy of your transaction history.

Calculate and report your crypto tax for free now. Imagine if Binance establishes partnership with us and has this capability in-built to send out tax forms directly to your email - that would be a great step towards. Now Ive been trading on Binance buying a bunch of alt coins Im interested in.

Yes Binance does provide tax info but you need to understand what this entails. They have their headquarters in Malta. Instead your crypto capital gains are taxed at the same rate as your Federal Income Tax rate and Provincial Income Tax rate.

This goes for ALL gains and lossesregardless if they are material or not. Answer 1 of 5. Jan 26 2022.

We have integrated Binance via API on BearTax with which one can consolidate trades review depositsreferrals calculate capital gains and download tax forms within few minutes. Go to your fiat and spot wallet. You will need to complete the KYC verification process to buy and sell.

You have to convert the value of the cryptocurrency you received into Canadian dollars. Offers over 500 different cryptocurrencies and a wide selection of investment tools. For the 2020 tax year the US individual income-tax return Form 1040 will require taxpayers to disclose their cryptocurrency dealings.

See our full list of pros and cons below. BinanceUS makes it easy to review your transaction history. Binance is currently one of the top rated crypto exchanges ranked 19 out of 199 in our reviews of Canada crypto exchanges with a rating of 7810.

This transaction is considered a disposition and you have to report it on your income tax return. US taxpayers will see the following question just underneath the address line on their Form 1040. Binance is the largest cryptocurrency exchange founded in 2017 by Changpeng Zhao.

Like you I put CAD in QuadrigaCX.

Crypto Traders Want Payback After Losing Millions To Binance Glitches

Ocryptocanada How To Report Your Crypto Taxes In Canada In 2022

The World S Largest Crypto Exchange Is Having A Hard Time Convincing Regulators With Multiple Bans Piling Up Business Insider India

How To Connect Binance And Koinly

Uk Financial Watchdog Bans Crypto Exchange Binance

Binance Us Review Pros Cons And More The Ascent By Motley Fool

Does Binance Work In Canada Quora

Ocryptocanada How To Report Your Crypto Taxes In Canada In 2022

Binance Tax Reporting Instant Tax Forms Cryptotrader Tax Demo Youtube

Ocryptocanada How To Report Your Crypto Taxes In Canada In 2022

Ocryptocanada How To Report Your Crypto Taxes In Canada In 2022

Does Binance Work In Canada Quora

Binance Tax Reporting Instant Tax Forms Cryptotrader Tax Demo Youtube